Table of Content

- Home Loan Interest Rates 2022

- How much should I spend on a car if I make $60000?

- What is an eligibility calculator for a home loan?

- Home loan eligibility based on age

- Comparison between Personal Loans and Car Loans

- Difference between flat and reducing interest rate

- How much personal loan can I get if my salary is 20000?

This ensures that he/ she can repay the loan amount effortlessly without defaulting. Failing to meet the eligibility criteria may lead to rejection of the loan application, leaving a negative mark on the individual’s credit profile. So, ensure to complete the processing faster and smoothly by fulfilling the required eligibility criteria. Lenders will also use this calculation to find a loan option that allows the borrower to make up to 3 times the required monthly repayment amount. Lenders determine loan eligibility depending on someone’s income and repayment capacity. They would like that the recommended EMI be between 50% and 60% of their net monthly income.

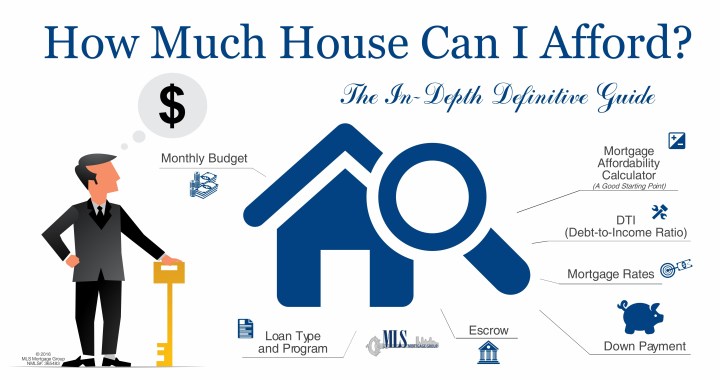

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs. The lower the DTI, the more likely a home-buyer is to get a good deal.

Home Loan Interest Rates 2022

If something happens to your appliance when you're away from home, or you are not there to turn it off before turning it off, most policies will cover the cost of repair or replacement. Individuals must be paid or self-employed persons or business people. You can also know your eligibility for a home loan through NoBroker’s Loan Eligibility Calculator.

The total number of periods is calculated by multiplying the number of years by 12 months since the interest is compounding at a monthly rate. With a salary of ₹ 18,000, the maximum amount he is eligible for is ₹ 3.75 Lakh . The interest he has to pay for this amount for 60 months is 10.70%.

How much should I spend on a car if I make $60000?

If you are one among them who want to realize your dream of buying a home, you will learn how the eligibility for a home loan is calculated. The loan amount you are eligible for depends on various factors such as your present age, monthly income, financial obligations, credit score, employment status and credit history. Individuals can easily check their home loan eligibility criteria on the official website of their preferred lending institution. Although most key requirements are usually the same, certain eligibility criteria may differ from lender to lender.

As of July 1st, 2020, the CMHC implemented new GDS and TDS limits for mortgages that it insures. It is considered on the amount left with you after deduction of any EMI amount that you are currently paying for any kind of loan. Your Home Loan Eligibility will be calculated after deductions of the EMIs that you are paying. To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages.

What is an eligibility calculator for a home loan?

Recheck all the entries and click on ‘check your eligibility’. The calculator displays the maximum loan amount you can borrow from Bajaj Finserv instantly. Applicants with a low borrowing capacity can benefit from exploring the addition of a guarantor to their loan.

Your salary is crucial as it helps in forecasting your repayment capabilities. Even if you earn a very handsome salary, a poor credit score can negatively impact your chances of getting a home loan. Generally, financial institutes prefer a credit score of more than 650.

The answer is yes, if your home insurance has electrical appliances as part of the coverage. If your electrical appliances are not currently covered by your home insurance, consider insuring them. Laptops are typically covered under home insurance policies, but the type of coverage is important.

As it is an unsecured loan, one of the benefits of a personal loan is that the borrowers do not need to pledge any asset against the loan. However, one of the main criteria to avail of a personal loan is the salary of the borrower. So, if your salary is less than Rs. 12,000, assure the lender that you have other sources of income to repay your personal loan on time. … With instant approval and 24-hour disbursal, the Bajaj Finserv Personal Loan is an ideal way to meet your needs for finance. Eligibility Criteria Salaried Self Employed Professionals Minimum Work Experience 24 months 36 monthsSecondly How much loan can I get on salary?

FHA loans also have a higher DTI threshold than most other loans which can help a lot when you get it. You may qualify with a DTI of 50% or even higher in some cases. It will be close, but it is possible with sufficient income and good value.

This will help one to opt for a lender that can provide housing loans at attractive terms to make repayment comfortable with EMIs spread over a favourable tenor. Verification of monthly income is mainly done to probe the repayment ability of the applicant. With 15,000 salary, borrowers can easily avail small cash loans ranging from 50,000 to 1,50,000. Personal loan has been commonly accepted by borrowers belonging to different salary slabs. Those earning a salary of Rs 15,000 belong to the starting range of a personal loan eligibility criteria. It means a minimum of 15,000 salary is mandatory to avail a personal loan.

No comments:

Post a Comment